Millennials are spending more time watching content on TV than they are on digital platforms.

As cord-cutting increases — combined pay-TV subscriber losses approached 1 million in Q2 2017 — and consumers turn to digital platforms to view content, it’s in the best interest of TV networks to present data that favorably paints traditional TV.

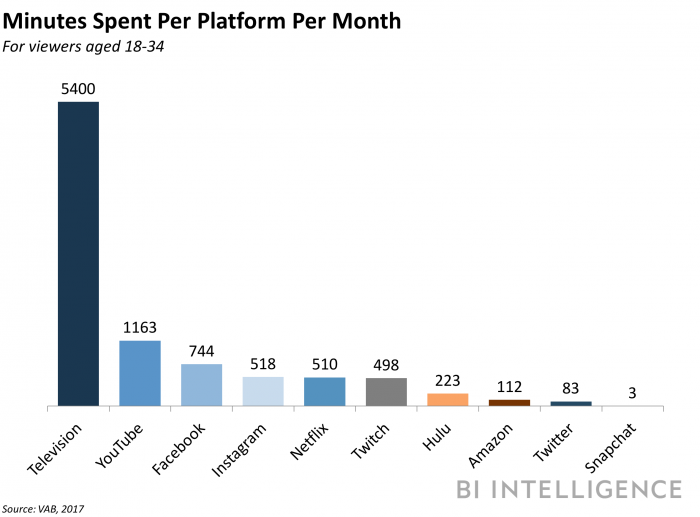

Millennials spend the most time per month watching TV, with YouTube, Facebook, Instagram, and Netflix trailing.

The top TV programs varied by genre, while the majority of YouTube’s top content is music videos.

- Millennials spend the most time per month watching TV, with YouTube, Facebook, Instagram, and Netflix trailing. Those aged 18 to 34 averaged 5,400 minutes per month watching live and time-shifted television, which was four times greater than YouTube, the platform with the second highest time spent per month, at 1,163 minutes. Facebook, Instagram, and Netflix trailed at 744, 518, and 510 minutes per month, respectively. This means brands that want to reach millennials should still be devoting a large portion of their ad budgets to traditional TV.

- The top TV programs varied by genre, while the majority of YouTube’s top content are music videos. The top 250 TV programs in 2017 were spread between six categories — drama, comedy, reality, news, sports, and documentaries — with drama being the most popular, commanding about 33% of the programs. On the other hand, YouTube’s top 250 most viewed videos were much less diverse, with 94% of the top 250 videos being music videos. The report argues that music videos lack the ability to elicit sustained emotional engagement, while TV provides the best opportunity. This means brands may be better positioned to capitalize on consumers’ emotions through commercials on TV.

Meanwhile, here are two counterpoints digital platforms could leverage:

- Cord cutting has already hit record numbers in 2017, and it’s reasonable to expect an overall weak Q3 for the pay-TV industry, according to analyst Craig Moffett. Moreover, cord cutting losses are projected to reach 5 million households per year, versus 2 million in 2016, indicating the subscriber losses may only get worse. This indicates that TV likely won’t be the platform that receives the highest amount of time spent from millennials in the long-term.

- Consumers are turning to digital devices when TV commercials are playing.Digital platforms provide a welcome distraction from TV commercial breaks — Facebook found that during the premiere of a popular TV show, viewers’ usage of the platform increased during every commercial break, for example. This indicates factors like high reach and emotional engagement associated with certain TV programs may not be as valuable, as consumers turn to their phones during commercial breaks.

As reported by Business Insider.

Leave a Reply