You may believe the myth that if you talk to your family about money, you have to start by revealing the family’s balance sheet. We disagree. In fact, providing that level of transparency may feel a bit overwhelming. You may also be concerned that it will have unforeseen consequences on your children’s lives.

Instead, remember to remain flexible and keep it simple. Speaking with your children about financial topics that are age-appropriate can be a helpful way of framing these discussions. Plus, you’ll be able to gauge your children’s reactions and maturity levels. If you follow this approach, you can reveal the dollar values and list of assets later.

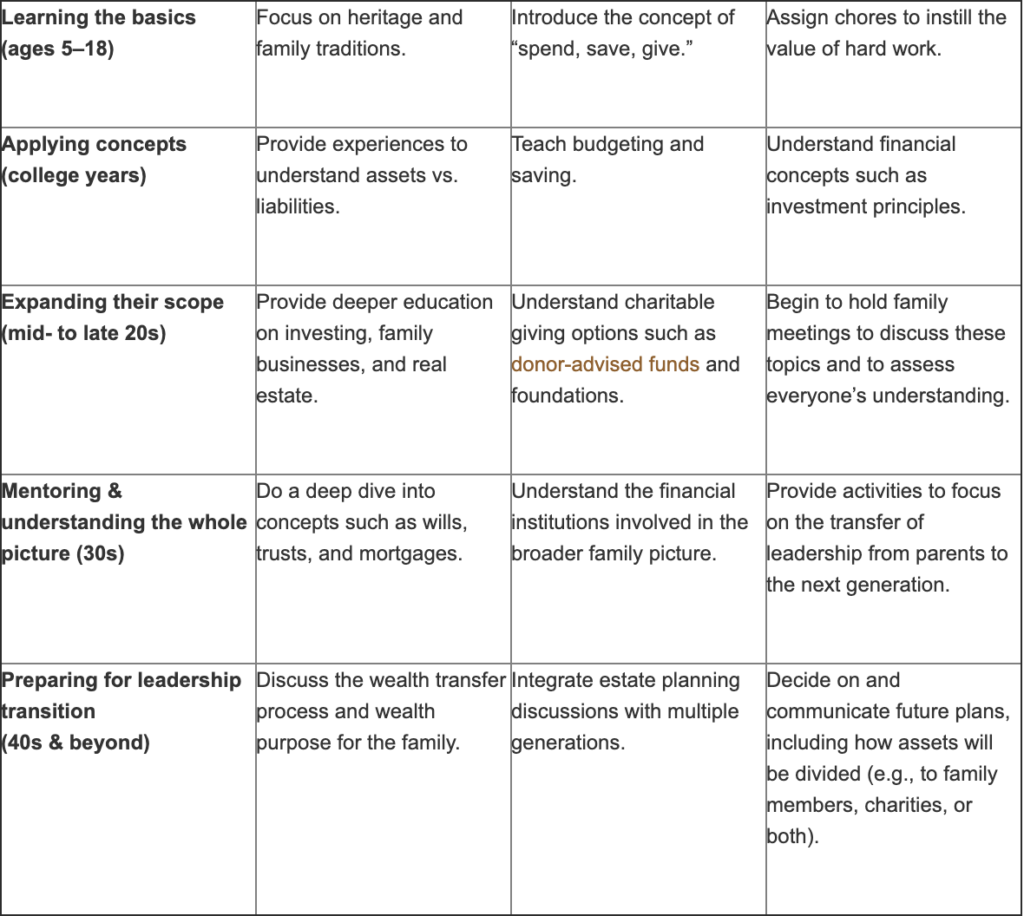

Here are some topics for family discussions:

Values—not dollars—are what truly matter

While you’re educating your family about money, we recommend that you also come to an agreement on your family values. Frankly, we believe this is good advice no matter how much money you have. All you need is a safe and comfortable environment where everyone can explore ideas and share what they’d like to be known and remembered for as a family. This can be an incredibly powerful learning experience for the next generation, as it can help them understand the meaning of “family wealth.”

And likewise, it’s your family’s journey and values that can help preserve your wealth and keep your family together for generations to come.