You have a FREE check coming from New York State if you are home owner and have no received one yet. You HAVE TO make sure you sign up by the end of 2023.

The average check statewide is $778 for the Basic STAR check and $1,407 for Enhanced STAR. The State has started sent out basic STAR and Enhanced STAR checks and if you HAVE NOT gotten one as of November, and are eligible, don’t worry, you didn’t miss out, even though the school taxes have been paid/due.

How do I get signed up to receive the STAR check from New York State?

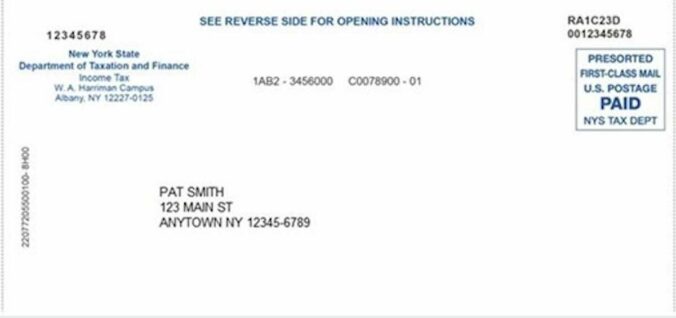

You must sign up for the program otherwise, you will not get a check. You can do it online or by phone. You have to register BEFORE December 31, 2023 and, according to the State, they say a check will be cut within 30 days. Here is where to enter your information.

What is the difference between the basic STAR check from New York State and the Enhanced STAR check? How do I get the ENCHANCED STAR Check?

The Basic STAR exemption is available to all eligible homeowners with incomes below $250,000, regardless of the owners’ age.

The Enhanced STAR exemption provides a larger benefit to seniors who meet the Enhanced income and eligibility standards. For starters, you need to be 65 or older by the end of 2023 and you must live in and own you home as your primary residence. Here are all of the criteria to get the ENCHANCED STAR check from the State?

- You own your home and it is your primary residence.

- You will be 65 or older by December 31, 2023. For jointly owned property, only one spouse or sibling must be at least 65 by that date.

- Your income must be $93,200 or less. The income limit applies to the combined incomes of all owners (residents and non-residents), and any owner’s spouse who resides at the property. For STAR purposes, income means federal adjusted gross income minus the taxable amount of total distributions from IRAs (individual retirement accounts and individual retirement annuities)

- To determine your income eligibility for the 2023 Enhanced STAR exemption, refer to your 2021 state or federal income tax return:

- Federal Form 1040. Adjusted gross income (line 11) minus taxable portion of IRA distributions (4B).

- New York State Form IT-201, Resident Income Tax Return

Check out the other criteria here on the New York State website.

You might already have your STAR benefits that automatically come off of your tax bill. Check the New York State website or your local town if you have any questions.