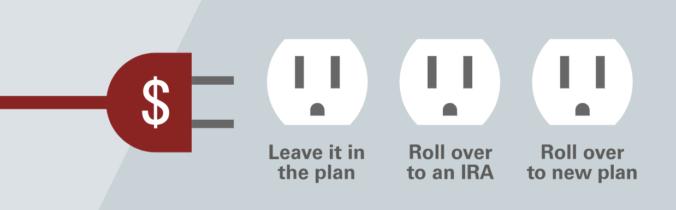

There are several ways to protect your savings for retirement after leaving an employer. In general, you can:

- Leave your money in the plan.You can usually leave your money where it is as long as your balance is at least $5,000. Your money can stay invested in the funds you’re familiar with. You just can’t contribute any more money.

- Roll over your money to an IRA. An IRA can open up new investment options. You can move your money to an investment company offering investments not in your previous plan.

- Roll over your money to your new employer’s plan.If your new plan accepts rollovers, you can bring the balance over from your old plan. That way your old and new retirement savings could be consolidated into one account.

In most cases, you don’t pay taxes on a direct rollover.

- Tip: If your old plan has a company stock fund, there are special tax rules that you may want to discuss with a financial or tax advisor.

- Caution: If you have a plan loan and leave your employer, you can pay back the loan in full or continue to make loan payments using electronic bank transfers.But if you don’t choose one of those options, the unpaid loan balance will be reported to the IRS as a withdrawal. That amount may then be subject to income tax. And if you’re under age 59½, you may also owe a 10% federal penalty tax.