Eighty percent of retired NFL players go broke in their first three years out of the league, according to Sports Illustrated.

Mario Henry was one of them. Out of football and money at age 28, Henry saw the financial woes of big-money ballplayers as symptomatic of a larger problem plaguing average Americans – a retirement problem. Experts say many people are inadequately prepared or ill-advised in retirement planning and outlive their funds.

Surveys this year by the National Institute on Retirement Security found 88 percent of Americans fear a retirement crisis, and 60 percent are behind schedule in what they need for retirement savings. Henry’s mission since he left football has been to educate and help people avoid the pitfalls of retirement planning.

“When I played football, we practiced against the worst-case scenario that we could face on game day,” says Henry (www.cya411.com), a financial services professional and author of How to Hire Your House.

“Many Americans are not planning the fourth quarter of their lives for those worst-case scenarios, and some who believe they are prepared may have a false sense of security.”

Henry gives three “don’ts” when planning your financial strategy for retirement:

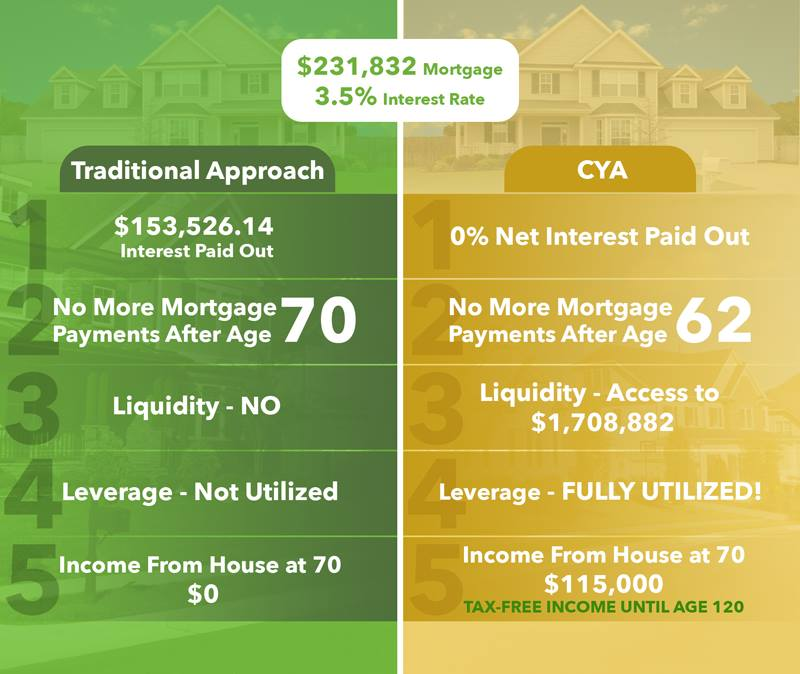

- Don’t leave your house paid off. Home equity and leverage can be a very powerful path for retirement income. That is probably one of the biggest secrets that most financial experts are not aware of. Even if the property’s value increases substantially from the original price, it’s not easily accessible, Henry says. “What we do not know and understand is that having a paid-off home effectively traps all the money that homeowners have given to the bank, plus appreciation in the house,” Henry says. “The only way you can use it is to take out a loan and use the house as collateral, or sell the house outright.”

- Don’t forget to factor in variables. Henry emphasizes that your financial adviser must factor in your life expectancy, the possibility of having a catastrophic disease, and at least a 3 percent inflation rate. “Don’t be satisfied when your financial adviser tells you how much money you should have by the end of your working years,” Henry says. “Ask what does that translate to hypothetically on a yearly net amount of income? Wall Street has absolutely zero to do with you having enough life-long income. Pensions are disappearing and now the middle class is having to gamble on the stock market.”

- Don’t buy into the 401(k) myth. On the front end, you’re delaying paying taxes on income you invest in a 401(k). But the back end can be a big problem; you have to pay taxes on the money when you withdraw it – and at age 70 ½ you are required to start making withdrawals whether you want to or not. This could be onerous, depending on your other sources of retirement revenue. “Many commonly accepted financial strategies such as using a 401(k) are, in reality, more myth than fact,” Henry says. “If people really understood all the negative implications of delaying taxes, they might think twice about using a 401(k), which wasn’t designed to provide life-long income, and search for some alternative retirement planning.”

“We have a retirement crisis in which the current financial methods in the near future will possibly fail millions of people,” Henry says. “There are going to be millions who will run out of money in the very near future unless they open themselves to new ideas.”

Leave a Reply