There are more than 22 million Americans who are now out of work and collecting unemployment benefits to help them get by, however, they might be surprised in April of next year when they learn that they owe taxes on all that aid coming their way. Even people who have suffered a huge drop in total income because of a job loss could be hit with a hefty tax bill since unemployment benefits are considered taxable income.

While unlike wages, you don’t have to cover any Social Security or Medicare taxes, you are responsible for federal, and sometimes state, taxes on the benefits. If you don’t pay enough throughout the year, it’s going to come back and haunt you come tax time. So what can you do to prevent it?

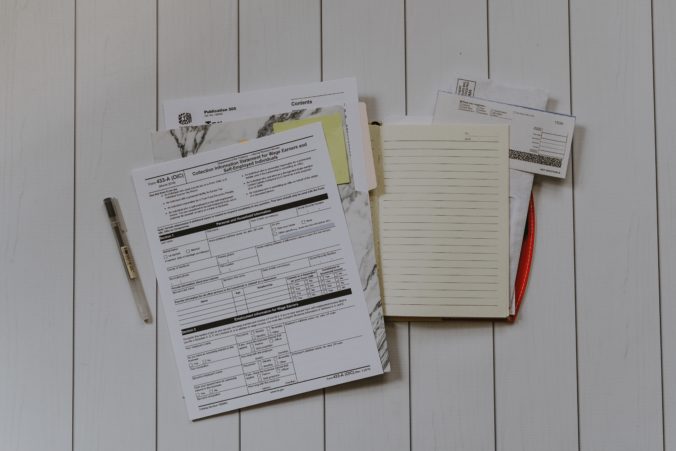

According to CNBC, your best bet is, when you apply for unemployment, to ask to have ten percent of your payments withheld to cover the taxes. If you are already getting benefits, the IRS Form W-4V, Voluntary Withholding Request lets you adjust how much you withhold.

If that doesn’t interest you, you could pay estimated taxes each quarter, but that also may not be a great option if you are unemployed.

That leaves one more possibility – save. Try to hold on to ten percent of your payment. Set it aside, perhaps in a savings account, to use to pay your potential tax bill