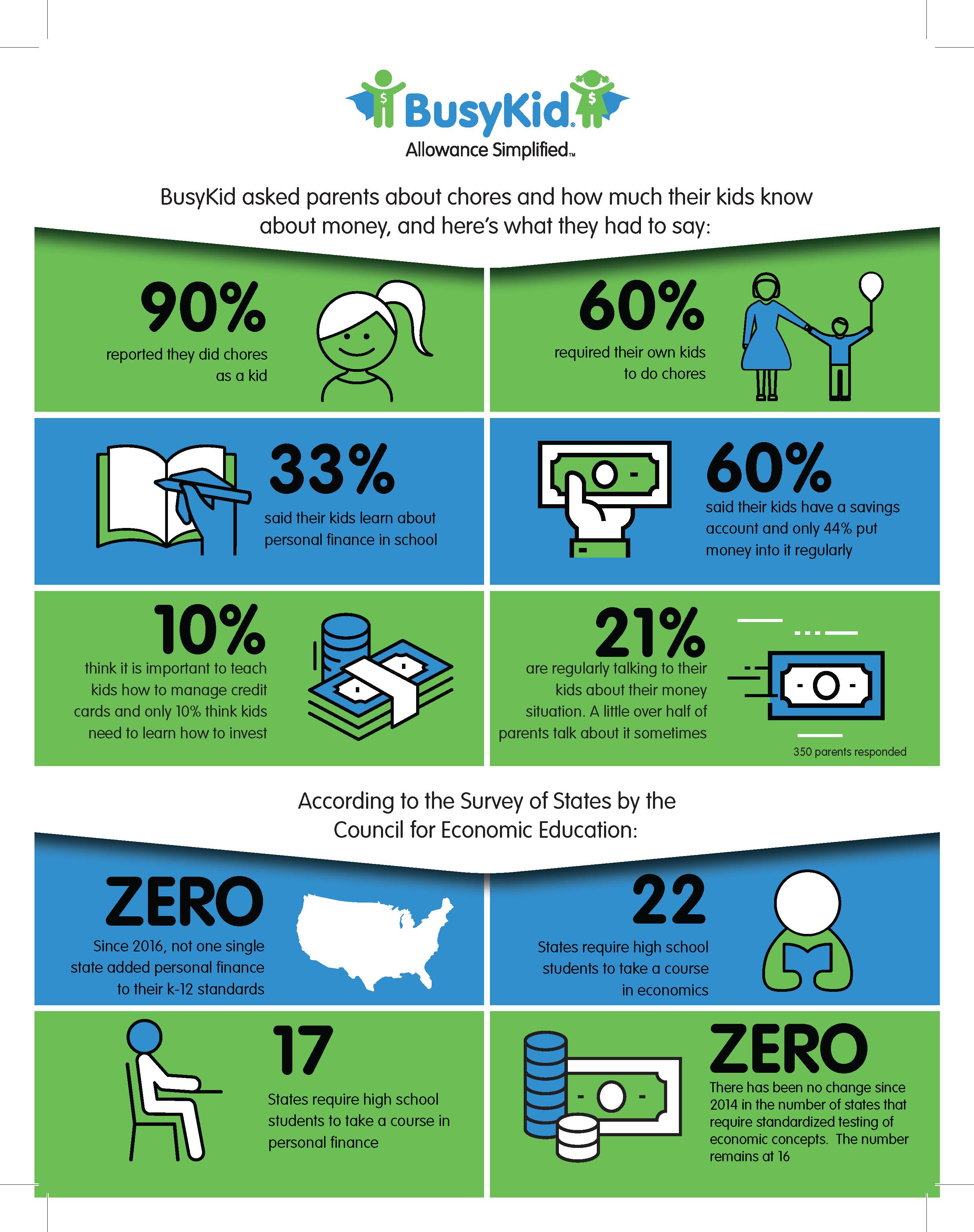

A new study of parents has discovered that most kids in America are not learning basic personal finance skills at home or at school. The study, conducted by BusyKid, found only 33% of parents said their kids learn about personal finance in schools, which aligns with results from the Survey of States by the Council for Economic Education.

The Survey of States found that 17 states (34% of states) require high school students to take a course in personal finance. Since 66% of states don’t require personal finance, the burden falls to parents, but according to the study only 10% of parents think it is important to teach kids how to manage credit cards, only 10% think kids need to learn how to invest, and only 21% of parents are regularly talking to their kids about their money situation.

Leave a Reply