Amid protests throughout the country against the treatment of black Americans, several black corporate and nonprofit leaders shared their views on the demonstrations with CNBC on Monday. They emphasized that the unrest in America is not just a result of racial injustice, but also the disparity in wealth between black and white Americans.

“This crisis has been brewing for hundreds of years, and we’re going to have to really step up to it,” Merck chairman and CEO Ken Frazier said Monday on CNBC’s “Squawk Box.” Frazier is one of only four black CEOs of Fortune 500 companies.

While many Americans believe the wealth gap between blacks and whites is about 20 cents on the dollar, in reality the median black family has only 10% of the wealth of the median white family. Black Americans are more than twice as likely as white Americans to be poor, and the black unemployment rate is almost double the rate for whites.

“Joblessness leads to hopelessness. Hopelessness leads to what we see in the streets,” Frazier said.

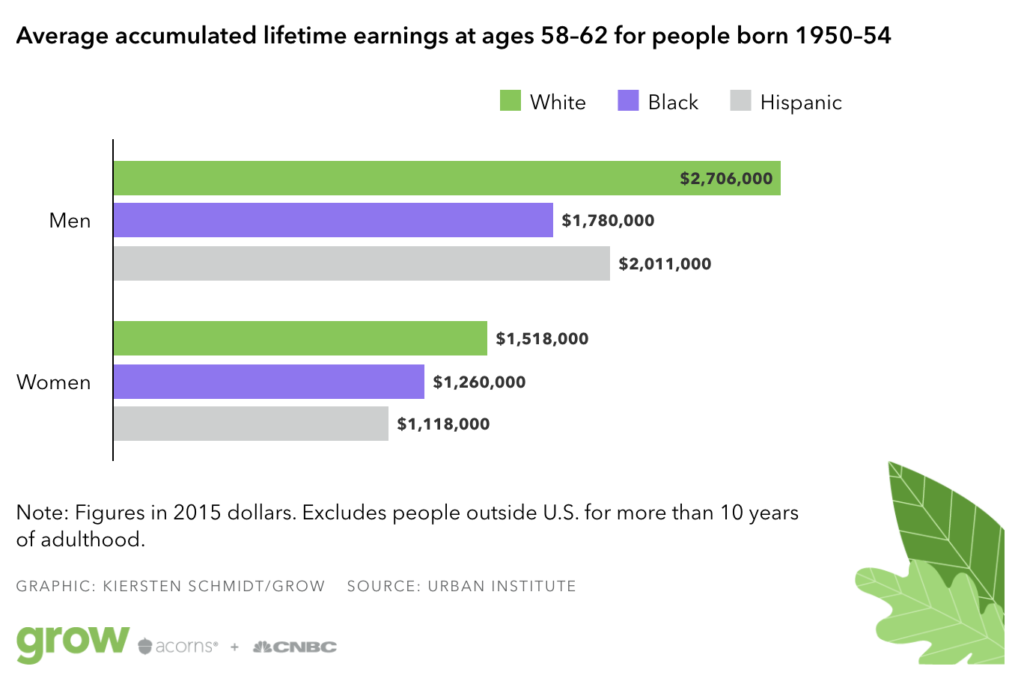

Overall, incomes in black households are about 40% smaller than those in white households, and black men earn up to $1 million less than white men over their lifetimes.

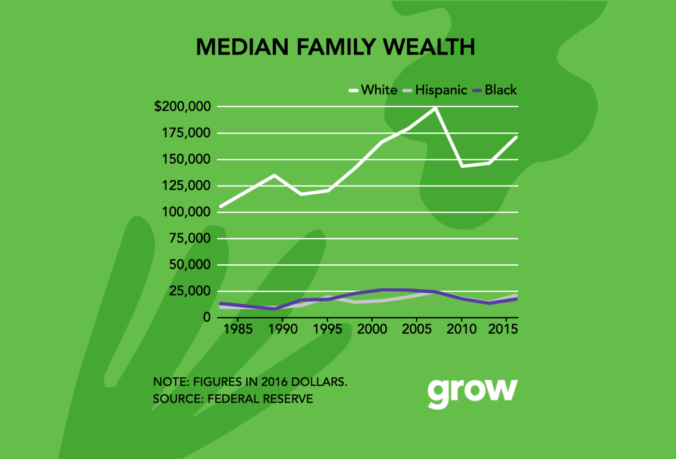

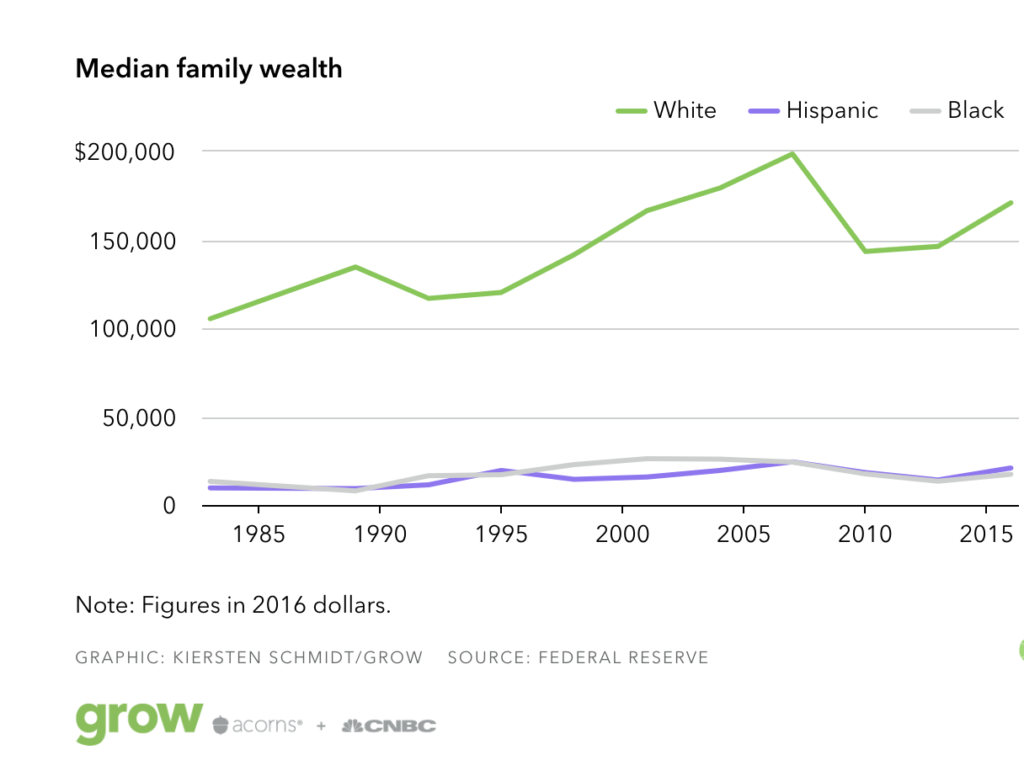

The racial wealth gap has gotten worse with time

In 2016, white families reported having $171,000 in wealth, or about 10 times the wealth black families reported having ($17,400), according to the most recent Federal Reserve Survey of Consumer Finances.

The disparity has worsened over time: In 1983, the first year the Fed conducted the survey, white families in the U.S. had about eight times as much wealth as black families.

While families in each category lost about 25% of their wealth between 2007 and 2010, white and Hispanic families have largely recovered from their Great Recession losses. For these groups, in 2016, wealth was down about 14% from 2007. Meanwhile, black families lost 28% of their wealth in that time.

We don’t yet know how much black families benefited from the economic growth of the late 2010s compared to other groups. More recent data will be available when the Fed releases the results of its 2019 survey later this year.

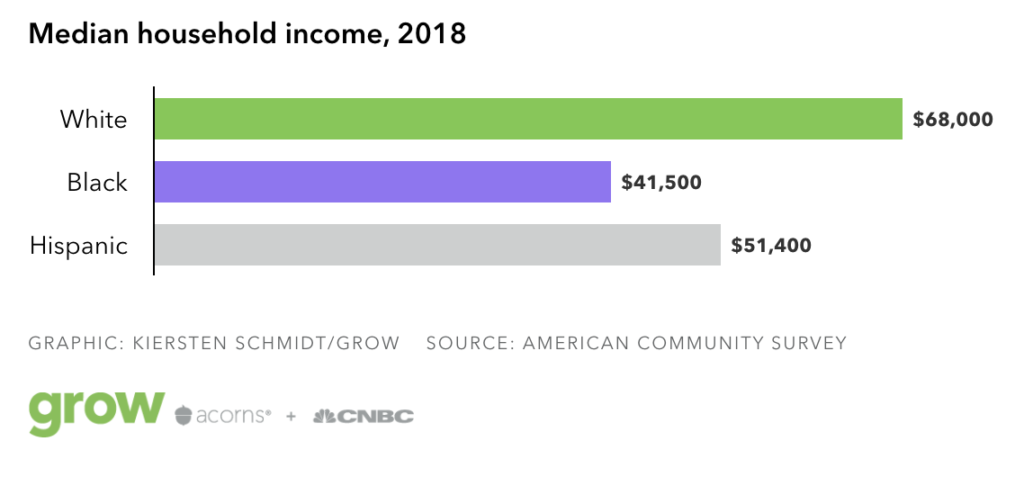

Lower income and more debt over years leads to less wealth

BlackAmerican families have earned significantly less moneythan white families for decades. The median household income for a black family was $41,500 in 2018, 40% less than the $68,000 for a white family. This gap has remained relatively unchanged since 1967.

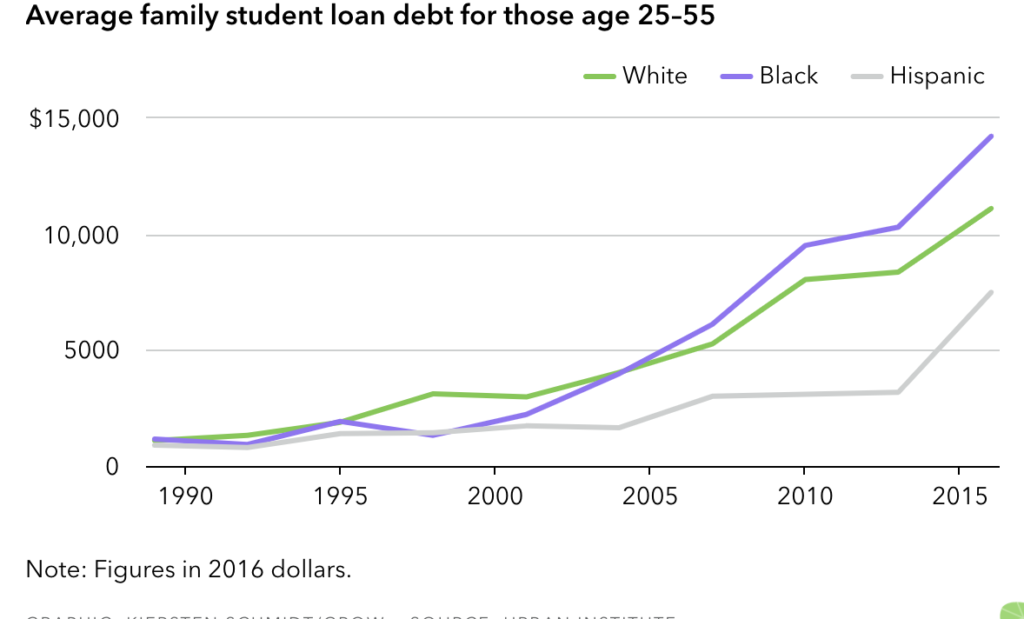

Because black families have less wealth and are less likely to receive inheritances that can be used to pay for college, they may be more likely to have to take out loans to finance their education. In 2016, 42% of families headed by a black adult aged 25-55 carried student loan debt, while only 34% of similar white families, and 22% of similar Hispanic families, did.

Since the mid-2000s, black families have carried more student loan debt than white and Hispanic families. The average student loan debt for a black family in 2016 was $14,000, compared to $11,000 and $7,500 for white and Hispanic families, respectively.

Adding to that burden is the fact that this debt doesn’t always turn into a degree that can help black families achieve greater wealth. Black students have significantly lower graduation rates than their white counterparts.

Black Americans are less likely to own homes

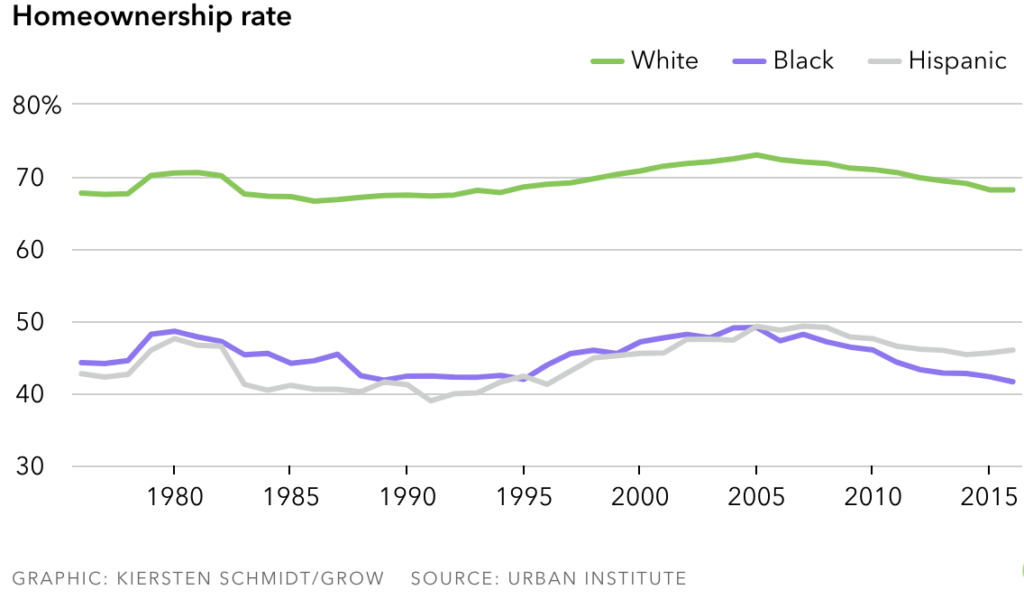

Having lower incomes and less wealth makes it more difficult for black families to purchase homes, which then contributes to their lower overall net worth. For decades in the 20th century, they were also subject to segregation and prejudicial practices like redlining that have made it much more challenging, if not impossible, for them to take out loans to buy homes.

In 2016, 68% of white families owned their homes while only 42% of black families did.

The housing crisis that triggered the Great Recession had a bigger impact on black families than other demographics. The share of black home ownership decreased from 49% to 42% between 2005 and 2016, while home ownership decreased from 73% to 68% for white families.

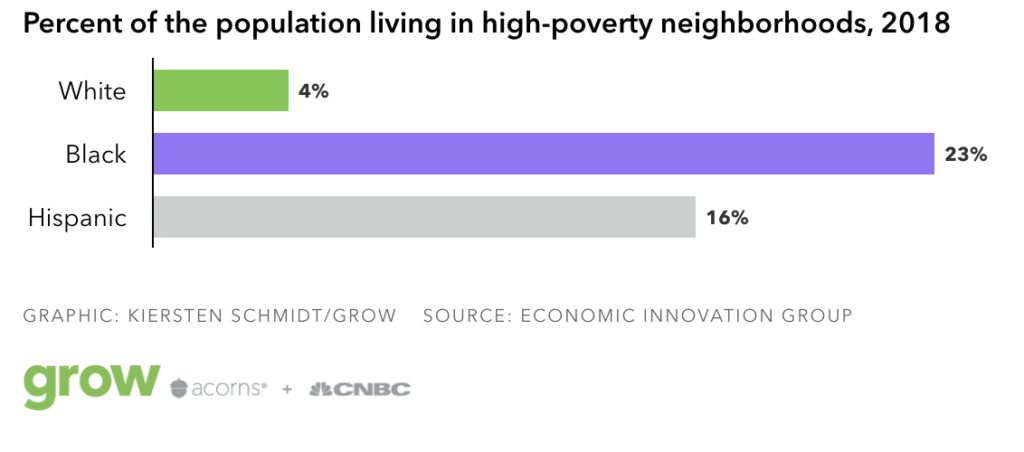

Lower wealth levels and homeownership rates mean that black Americans are significantly more likely to live in high-poverty neighborhoods, where they have less access to jobs, high-quality education, and other services that are the foundation of strong economies. In 2018, 23% of black people lived in high-poverty neighborhoods compared to just 4% of white people.

“We need to acknowledge that there are huge opportunity gaps that are still existing in this country,” Frazier said on “Squawk Box.” To close those gaps, “financial literacy is critical. Education is critical. That is the great equalizer.”