There are certain milestones that define time for many people. Some of them, like first words, first steps, and the first ever day of school, are witnessed for you by parents or caretakers—and don’t stay in your memories. Then there are the moments that you will always remember—graduating from elementary school, your first job, and getting your learner’s permit.

Then there’s the day you are truly out on your own, maybe after slogging through college or university, and you get a letter that tells you how much you owe in student loans and where to send the payments. For me, it was an awakening on a number of levels. Call it ignorance, but the total amount for all the promissory notes I signed over the years hadn’t registered until then—and the realization that life on my own was starting in a financial deficit quickly followed.

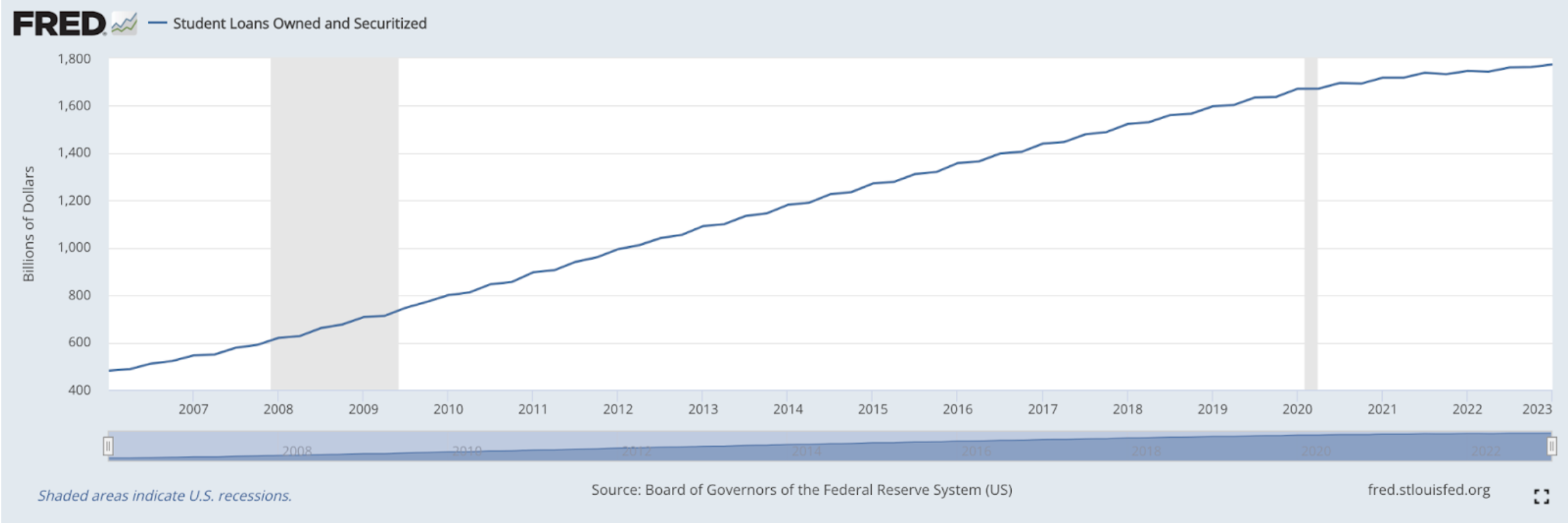

As of March 2023, there is more than $1.77 trillion in outstanding student loans, of which 87% is in federal loans (vs. private). It’s no wonder, given the rising cost of tuition over the last thirty years. According to the College Board, from 1992 to 2022, the average annual published tuition and fees more than doubled from around $5k to just under $11k at public four-year institutions, while average private college tuition also just about doubled from $21k to $39k.

No wonder the most recent data suggests the average debt level among all bachelor’s degree earners in the US is around $29k.

Back to the US, the COVID-19 moratorium on student loan payments is set to end September 1, 2023, with the first payment due in October. It’s like a countdown clock to a smaller checking account. But all is not lost. There are some tips and pointers to consider if you find yourself having to make those payments again:

- Make sure the loan servicers have your most up-to-date information. Basic for sure, but lots of people moved in the last few years. If you did, update your info so you don’t miss important updates.

- Pull together your high-level budget (again), and regroup. This may be obvious, but confirm what your monthly payment will be and then review what you spend relative to what you earn. If there’s any way to make some changes, it could make room for the new/renewed expense.

- Consider an income-driven repayment (IDR) plan. If your budget shows you really can’t make the payments, an IDR plan may be the way to make it work. This plan adjusts your payment amount based on your income and family size. If you were on one before the pause, you’ll need to recertify within the next six months.

- (Re-)set up auto payments, which may reduce your rate. With a direct debit, your monthly payment is taken automatically from your bank account each month. It’s a good way not to forget and typically comes with a discount of 0.25%. Even if you had this set up before the pause, you may have to re-enroll.

- Put it in your tax return. Once you start making payments, don’t forget you may be eligible to deduct student loan interest against your income when you file your taxes. Also, if you contribute to a 401k or IRA, this will lower your income (adjusted gross income) which can lower your payment in an IDR plan (see above).

- Consider the order of repaying what you owe. If you find yourself with extra funds any given month, use it to pay back any debt in order of the cost (aka the interest rate), starting with the highest. This typically means you cut your high-cost credit card debt first, where the average rate is 22%, before paying down more of your student loan, where the average rate is around 6%.

- If you can pay more than your monthly payment, request it goes to your principal rather than the next monthly payment. This means the money would go directly to reducing the size of the debt. Without this request to the servicer, payments go to fees, then interest, then principal, in that order. Making extra payments can save you on interest and time to full repayment.

It’s a lot, but don’t put off handling it if you’re facing payments in a few months. The better prepared you are, the better you will feel, so you can focus on making new positive memories.

PS: I found this to be a good resource: COVID-19 Relief and Federal Student Aid

Source: The Federal Reserve, The College Board, The Institute for College Access and Success, OECD, Education Data Initiative

Chart: Board of Governors of the Federal Reserve System (US), Student Loans Owned and Securitized [SLOAS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SLOAS, July 17, 2023.